Fill out your information, and we'll do the calculations for you

Make a Paystub That Works for You

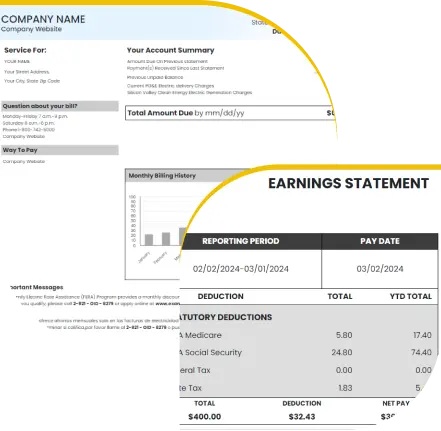

Paystub Creator keeps the process simple. Whether you are an hourly worker, self-employed, or handling payments for a small group, it helps you build paystubs that reflect real details. Pick a layout, add the numbers, and download your file without delay.

Change What You Need Without the Stress

Each paystub follows a layout that matches what landlords, lenders, and employers often expect to see. You can adjust dates, job roles, income, and withholdings without hassle. The totals for gross pay, deductions, and take-home pay are shown in a way that feels familiar and clear.

You Stay in Charge of Your Details

Your personal details stay in your hands. Paystub Creator uses secure tools, and no data is stored or shared. If the file does not meet your needs, a refund is available within thirty days. You can use the tool freely, with full control over your own information.